Please contact us at 88 for a free debt analysis and for complete program details. As each situation is unique, fees and costs vary. **Disclaimer - We do not charge upfront fees and you do NOT pay our fee until a settlement has been arranged, you approve the settlement, and at least one payment is made towards the settlement. Read and understand all program materials prior to enrollment, including potential adverse impact on credit rating. Please consult with a bankruptcy attorney for more information on bankruptcy.

DEBT MANAGEMENT SOFTWARE FOR MAC PROFESSIONAL

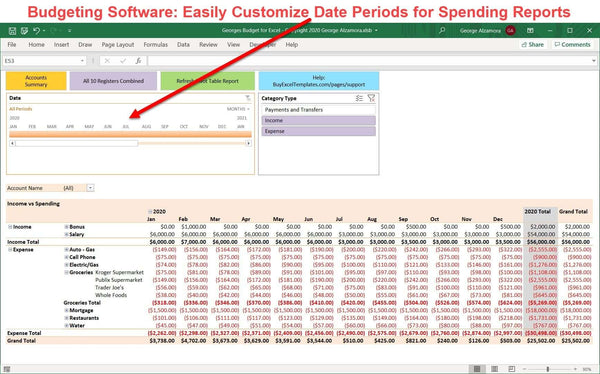

Please contact a tax professional to discuss tax consequences of settlement. We do not assume consumer debt, make monthly payments to creditors or provide tax, bankruptcy, accounting or legal advice or credit repair services. We do not guarantee that your debts will be lowered by a specific amount or percentage or that you will be debt-free within a specific period of time. Estimates based on prior results, which will vary based on specific circumstances. Not all clients complete our program for various reasons, including their ability to save sufficient funds. Not all debts are eligible for enrollment. Clients who are able to stay with the program and get all their debt settled realize approximate savings of 50% before fees, or 30% including our fees, over 24 to 60 months. Please also note that all calls with the company may be recorded or monitored for quality assurance and training purposes. But for now, it’s time to celebrate.We do not discriminate on the basis of race, color, religion, sex, marital status, national origin or ancestry. If you’ve got a mortgage, you’ll hit that hard later. It's the day when every single cent of your consumer debt is history. This money management tool lets you see your entire financial life in one place. Why don’t we ask you to list your mortgage in your debt snowball? Because after you’ve knocked out your consumer debt, you’ve got other important steps to take before tackling the house. Quicken is a company that offers comprehensive financial tracking software with a debt reduction component. Yes, that includes your car notes and student loans. It’s everything you owe, except for loans related to the purchase of your home. So, if you borrowed $20,000 over 10 years, your principal payment would be about $167 per month. We’re talking about the amount of money you borrowed without the interest added. No, it's not that elementary school principal you were terrified of as a kid. Your interest rate is how much they charge, usually shown as a percentage of the principal balance.

Lenders are interested in letting you borrow their money because they make money on what they loan you. When it comes to borrowing money, there’s no such thing as free. If your original loan was $20,000 and you’ve paid $5,000 already, your balance would be $15,000. It's the amount you still have to pay on your debt. Pay any less and you might get slapped with some hefty penalties. This is the lowest amount you are required to pay on a debt every month (includes principal and interest). You're just not good enough.ĭebt terminology can be confusing and overly complicated-but it doesn’t have to be! Let’s break these down in a way you can actually understand. No more watching your paychecks disappear.īecause when you get hyper-focused and start chucking every dollar you can at your debt, you'll see how much faster you can pay it all off.

Step 4: Repeat until each debt is paid in full. Step 3: Pay as much as possible on your smallest debt. Step 2: Make minimum payments on all your debts except the smallest. Step 1: List your debts from smallest to largest regardless of interest rate. It is a standalone product that provides a complete debt collection solution. Latitude by Genesys Latitude by Genesys is the right solution package for accounts receivable management. With every debt you pay off, you gain speed until you’re an unstoppable, debt-crushing force. We are going to discuss the top 10 best debt collection software products in this article. Why a snowball? Because just like a snowball rolling downhill, paying off debt is all about momentum. Then, take what you were paying on that debt and add it to the payment of your next smallest debt. The debt snowball is a debt payoff method where you pay your debts from smallest to largest, regardless of interest rate.

0 kommentar(er)

0 kommentar(er)